Authors: Ryan Sydnor, Aviv Sheriff, Emily Shaw.

HashChain Technology Inc. (KASH.V)

This analysis is focused on HashChain Technologies, Inc. They were founded on August 15th, 2017 and operate in the rapidly expanding cryptocurrency market. On September 25th, 2017 raised $4.4M and went public on December 18th, 2017 on TSXV with a ticker symbol KASH. Their market capitalization upon IPO was $108M, however after a 2:1 split on February 5th, 2018 and significant losses in stock price, their market capitalization is now $21.5M. 1

The company is currently scaling up, so its operating costs exceed its revenue and it is dependent on external funding. In absolute numbers, this means they’ve lost $5.3M in the past six months. While their operating cash flows are approximately -$800K per month, their liquid assets total $20M which gives them sufficient runway at their current burn rate to continue scaling.2

Cryptocurrency Market

Cryptocurrencies are a digital, decentralized substitute for traditional, government-backed fiat currency. There are many parallels between government-backed currencies and cryptocurrencies: there are multiple variants, the value is driven by demand (rather than any “true” underlying value), and as demand increases an entity introduces more supply. In the case of cryptocurrency, this is called “mining”. Mining a coin is computationally intensive and requires an update to the network upon completion. Therefore, mining benefits from Moore’s law (computing power will get cheaper over time), network speed (ability to quickly update the network), the cost and availability of electricity (to power the computers, or “rigs”), and low temperatures (high speed computers generate a lot of heat).

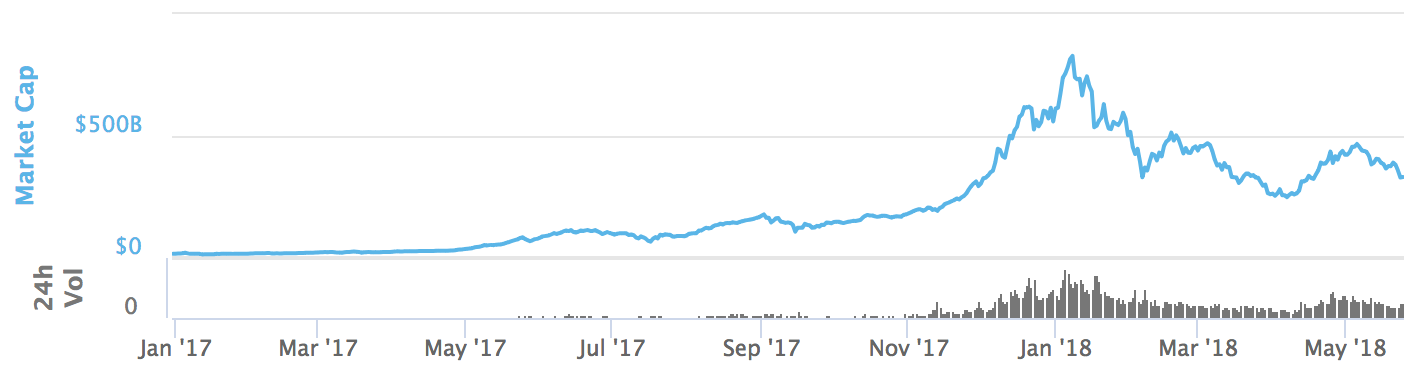

The number of cryptocurrencies and the value of each cryptocurrency has been increasing with time. There are approximately 1600 unique cryptocurrencies with a combined total market capitalization of $500B.

Current total market capitalization of all cryptocurrencies.3

Current total market capitalization of all cryptocurrencies.3

HashChain Strategy

HashChain Technologies has three major strategies within the cryptocurrency market.

Cryptocurrency Mining

HashChain has made a number of strategic purchases to decrease the input costs of mining. They have secured space in data centers located in Montana and Vancouver.

This shows Montana and Vancouver as advantageous locations for cryptocurrency mining due to their abundant but low cost electricity and internet connection speed.4

This shows Montana and Vancouver as advantageous locations for cryptocurrency mining due to their abundant but low cost electricity and internet connection speed.4

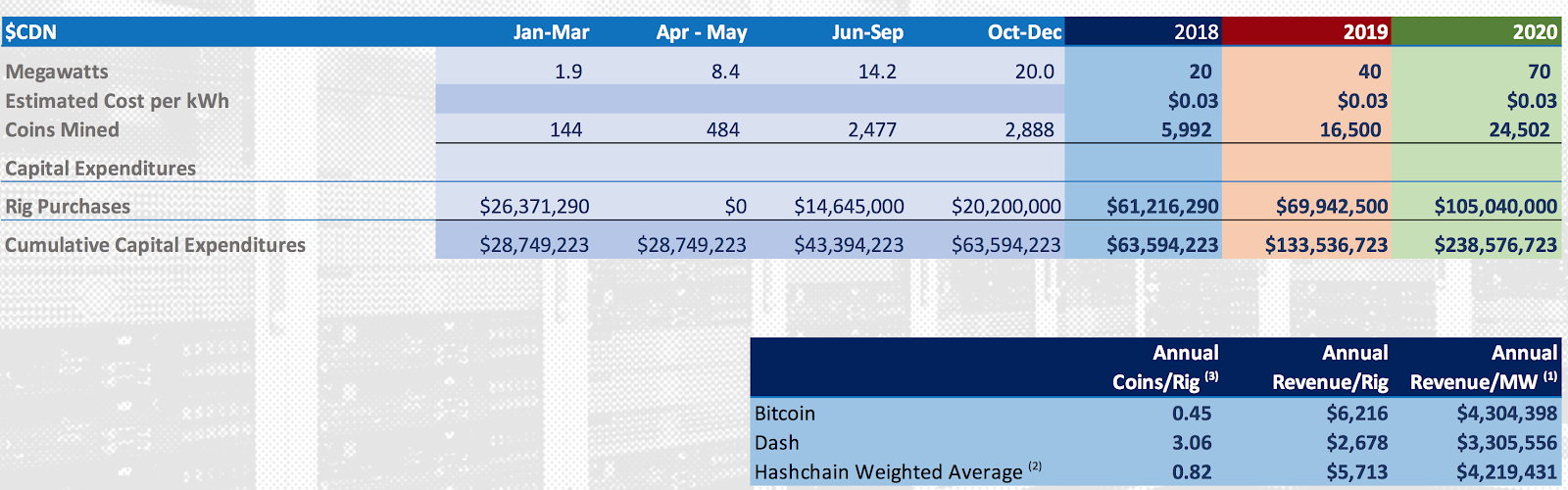

Today, they have a 5.5 Megawatt (MW) mining operation. They plan to expand to 20 MW by 2018, 40 MW by 2019, and 70 MW by 20205. When viewing cryptocurrency mining operations through a financial lens, you want to consider revenue per MW. Assuming market conditions hold stable (price per coin), this puts HashCoin on track to scale revenue with energy capacity, as detailed in the below financial forecasts.

They have formed partnerships with the largest rig manufacturers in the world (BitRig Technology Inc.)6 which will allow them to scale their mining operations. This allows HashChain to easily pivot their existing rigs to mine other cryptocurrencies because of their application specific integrated circuits (ASICS). These ASICS are a technology ceteris paribus.

HashChain’s CEO, Patrick Gray, has stated that they plan to become the largest cryptocurrency mining company in the world.7

Cryptocurrency Services

HashChain made an $8M acquisition of NODE40, a developer of cryptocurrency tax and accounting software8. Governments are beginning to require that cryptocurrency gains be audited and taxed. HashChain is uniquely positioned with one of the first services that seamlessly integrates with multiple cryptocurrency exchanges to automatically track, audit, and report an individual’s transactions. This software is still in beta with only 1200 users and is not currently generating any cash flow.

HashChain is also a major contributor to the Dash cryptocurrency as it hosts multiple masternodes. A Masternode handles Dash transactions for a fee. Masternode ownership also gives the owner voting rights in the strategic direction of Dash. While we don’t expect Masternode hosting to be a major driver of revenue going forward, it did account for $550k last year. It doubles as a great way for the company to keep a pulse on and stay involved in the cryptocurrency community.

Intellectual Property

HashChain’s intellectual property play is still on the horizon as they focus on scaling their mining operation and services. Regardless, it is an important component of their strategy as it shows they are thinking holistically about the ecosystem. To facilitate their mining operations, they are looking into hardware patents, mining algorithm software optimizations, and software to monitor mining rigs (they recently acquired NodeMonitor.io9). To broaden their cryptocurrency services, they are considering building a platform to facilitate transactions, similar to Coinbase. Finally, they are in the early stages of exploring creating their own cryptocurrency.10

Long Run Return Analysis

HashChain is currently making negative profits due to high fixed costs associated with entering the market and scaling (filing fees, mining rigs and data centers, etc.). It will likely achieve short run profits but no long run profits because the cryptocurrency mining market will eventually reach perfect competition.

| Current | Short Run | Long Run |

|---|---|---|

| Negative (TC>TR) | Positive (TC<TR) | Zero (TC=TR) |

HashChain is currently just one player in the growing cryptocurrency mining market. They are far from a true monopoly. Neither are they a natural monopoly, because although fixed costs to enter the industry are high, fixed costs are not high enough to deter other firms from entering or exiting, and the hardware costs will continue to decrease over time according to Moore’s law.

They face direct competition from Riot Blockchain (market cap $84M), SV CryptoLab (a subsidiary of 360 Blockchain, market cap $16M), DMG Blockchain (who perform mining-as-a-service for third parties, market cap $40M), Hive Blockchain (market cap $398M), and others. Each of these companies owns cryptocurrency mining facilities, meaning they have already paid the fixed costs to enter the market.

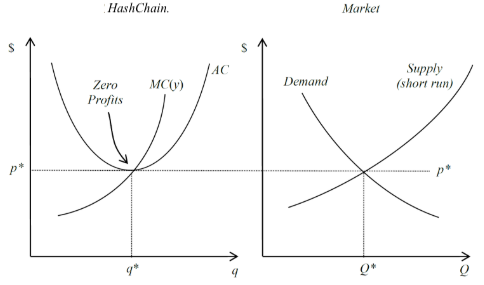

Because there are several firms and individuals producing cryptocurrency, and many demanders who do not care which firm produces the coins they purchase, the cryptocurrency mining market is approaching perfect competition. In perfect competition, each firm’s long run profits will go to zero as more firms enter. More firms will enter up until the point where the total costs of operating within the market, equal to Variable Costs (energy and Internet) plus Fixed Costs (mining rigs and data centers), outweigh Profits.

As shown above, each firm in perfect competition will produce at the minimum point on the AC curve.

As shown above, each firm in perfect competition will produce at the minimum point on the AC curve.

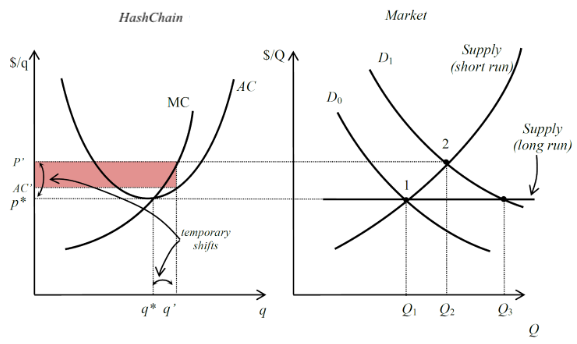

It is also likely that demand for cryptocurrency will increase with taste as a ceteris paribus condition (because societal interest in cryptocurrency is growing), but this still will not result in long run profits.

In perfect competition, demand increases drive up the price. In the short run, existing firms increase their supply to Q2 (or Q’ in the left graph). However, in the long run, more firms enter the market, which brings firms back to Q. The overall supply increases to Q3, because more firms exist overall. Prices go down to reflect the increased competition.*

In perfect competition, demand increases drive up the price. In the short run, existing firms increase their supply to Q2 (or Q’ in the left graph). However, in the long run, more firms enter the market, which brings firms back to Q. The overall supply increases to Q3, because more firms exist overall. Prices go down to reflect the increased competition.*

Although we believe that cryptocurrency mining is approaching perfect competition, HashChain’s other two lines of business (cryptocurrency services, including hosting Dash masternodes, and intellectual property) are clear plays to gain monopolistic advantages in the larger cryptocurrency market. Both of these lines of business will result in short term profits.

HashChain’s cryptocurrency services, such as their SaaS products and buying up Dash masternodes, will only allow them to have positive short term profits until enough other firms enter the market, at which point long run profits will go to zero. Currently, their only chance at monopolistic competition is through their third business line (amassing intellectual property such as key cryptocurrency-related patents), because they will own a specific segment of the industry. However, it is unlikely they will be able to secure valuable enough intellectual property to give them a true advantage.

HashChain’s Chief Technology Officer, Sean Ryan, confirmed in our May 29th meeting that the company is currently shifting its strategy away from mining to focus on cryptocurrency services. He said, “It’s hard to gain a competitive advantage in mining. Maybe you can get cheaper power by expanding to places with lower prices, or lower your overheard by building facilities rather than renting them, or building next to a waterfall. But at the end of the day, it’s a level playing field because everyone is running the same equipment. Our long play is to expand our other services.” According to Ryan, the company now views its mature mining operation as a platform from which to gain market credibility, leading to strategic partnerships that will benefit their services business by attracting large customers in the future.

As we predicted, Ryan stated that HashChain is expecting competition even in their services business. “Being first to market is our biggest advantage there because we’re not solving problems that others can’t solve. We’re asking ourselves, ‘How will people use digital currencies in the future and what ancillary tools will they need in order to succeed?’. But it’s very hard to find IP in this space. Patenting is hard because once you identify the problem there are so many different ways to solve it.”

Proposed Strategy

Switch Focus to SaaS

The Cryptocurrency mining market is perfectly competitive and will reach zero long run profits. Many companies are already competing for short run profits in crypto-mining. However, Crypto-currency SaaS is an emerging market. HashChain purchased the only currently available tax reporting software for cryptocurrencies - NODE40. In our interview with HashChain CTO Sean Ryan, he indicated that increasing government regulation11 around cryptocurrencies will create greater demand for accounting software such as NODE40. This Software as a Service (SAAS) product has very low marginal costs and high fixed costs to enter (in R&D), which resembles a natural monopoly market. HashChain should attempt to cement themselves as a monopoly by instituting the following barriers to entry:

- R&D Costs. Hashchain should integrate locality-specific tax reporting regulations in their software. This is an arduous process and would take time for competitors to catch up.

- Intellectual Property. HashChain should delay competitors by protecting the intellectual property behind its accounting software. Early-stage companies will have a difficult time defending patent charges while developing competing products.

- Strategic Partnerships. HashChain should partner with regulatory bodies to ensure that HashChain’s cryptocurrency tax software gets a governmental stamp of approval, e.g. from the IRS. In addition, early strategic partnerships with large auditing companies can help HashChain acquire many users quickly and block entering firms from scaling.

- Lobby for Regulation. Additional regulations on digital currencies will increase demand for HashChain’s tax reporting software. Therefore, HashChain should lobby for more cryptocurrency regulations. By adapting quickly to regulations, HashChain can further increase the barriers to entry for competitors.

- Merge with Competitors. If competitors arise in digital currency tax reporting, HashChain should buy them out or merge as soon as possible. This will allow HashChain to maintain monopoly profits.

- Institute Switching Costs. HashChain should make it difficult for current users to switch to potential competitors’ software. HashChain can achieve this by creating a learning curve for its software and offering free online trainings to teach auditors and users.

Price Discrimination in SaaS

As long as HashChain is the only firm providing cryptocurrency tax software services, it can benefit from price discrimination. Among users who are cryptocurrency miners, HashChain should discriminate by locality and type (enthusiast/enterprise):

- Locality - HashChain should engage in 3rd degree price discrimination. Miners in countries where electricity cost is lower likely make greater profits and can afford to pay more for the tax service software. Hashchain should vary the cost of subscription to its software service based on electricity cost in a country or state.

- Enthusiast/Enterprise Miners - Cryptocurrency miners are divided into enthusiastic individuals and enterprises. HashChain should split its product into “Enthusiast” and “Enterprise” subscriptions and include more features in the enterprise subscription. Enterprises should be charged considerably higher prices to maximize profits. In this way, Enterprises and Enthusiasts will self-select.

Salvage Mining Operations

Because cryptocurrency mining is highly competitive and non-profitable in the long run, HashChain should salvage their operations in this sector. Short-run profits from crypto-mining as well as the sale of any mining assets should be used to fuel further R&D efforts in their SaaS-accounting division.

References

- https://finance.yahoo.com/quote/KASH.V/

- April 25th Interim Financial Statement: https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00043472

- https://coinmarketcap.com/charts/

- https://www.jbs.cam.ac.uk/fileadmin/user_upload/research/centres/alternative-finance/downloads/2017-global-cryptocurrency-benchmarking-study.pdf

- http://hashchain.ca/downloads/HashChain-Corporate-Deck.pdf

- Apr 25th, 2018 MD&A: https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00043472

- HashChain Technology CEO: We Want to Be the World’s Biggest Cryptocurrency Miner: https://www.youtube.com/watch?v=ILks8La_aHg

- https://www.hashchain.ca/hashchain-technology-has-completed-its-acquisition-of-established-blockchain-technology-company-node40/

- https://www.hashchain.ca/hashchain-technology-acquires-nodemonitor-io-to-further-strengthen-its-cryptocurrency-hosting-service/

- https://youtu.be/i2FeXIIHBXA?t=1m13s

- https://www.cnbc.com/2018/03/27/a-complete-guide-to-cyprocurrency-regulations-around-the-world.html